Fannie Mae recently released their “What do consumers know about the Mortgage Qualification Criteria?” Study. The study revealed that Americans are misinformed about what is required to qualify for a mortgage when purchasing a home. Here are three takeaways:

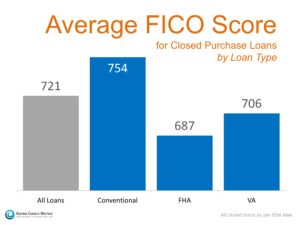

- 59% of Americans either don’t know (54%) or are misinformed (5%) about what FICO score is necessary

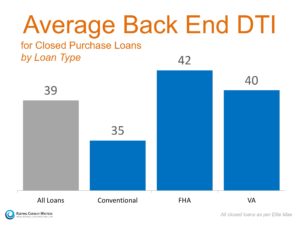

- 86% of Americans either don’t know (59%) or are misinformed (25%) about what an appropriate Back End Debt-to-Income (DTI) ratios is

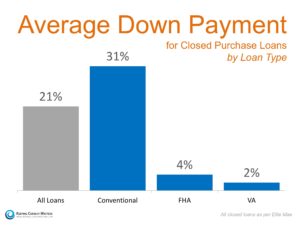

- 76% of Americans either don’t know (40%) or are misinformed (36%) about the minimum down payment required

To help correct these misunderstandings, let’s take a look at the latest Ellie Mae Origination Insight Report, which focuses on recently closed (approved) loans.

FICO Scores

Back End DTI

A Down Payment

Bottom Line For Central OH Home Buyers

Whether buying your first Columbus home or moving up to your dream home in Westerville, knowing your options will definitely make the mortgage process easier. Your perfect home may already be within your reach! Contact me, Central Ohio REALTOR® Rita Boswell at 614-830-9767, to learn more about what you need in order to buy a home in today’s real estate market.